Architecting a strategic, data- and market-driven framework for R&D commercialization

Leading research institute engages Stryber to turn innovation into application

The story in brief

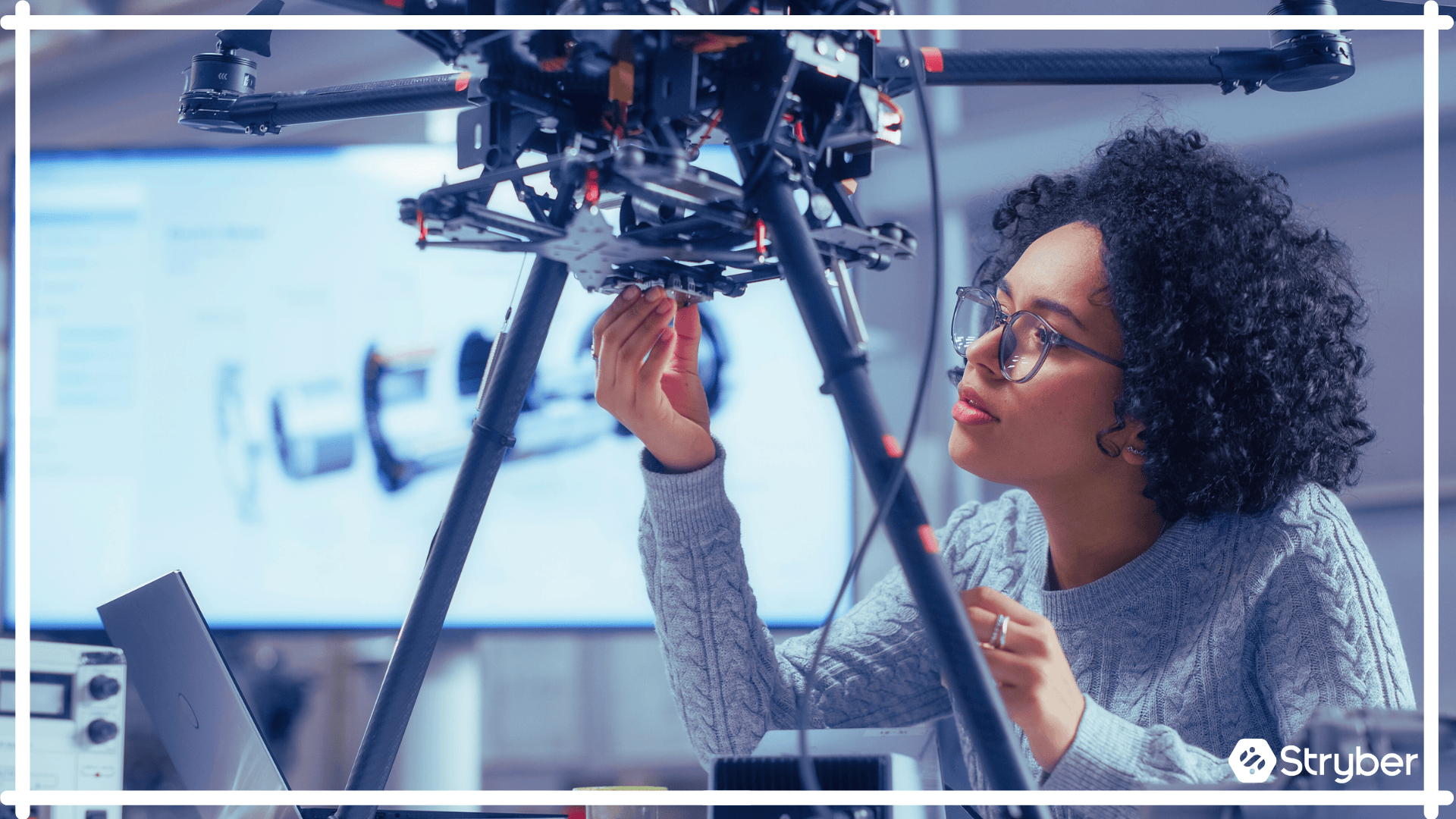

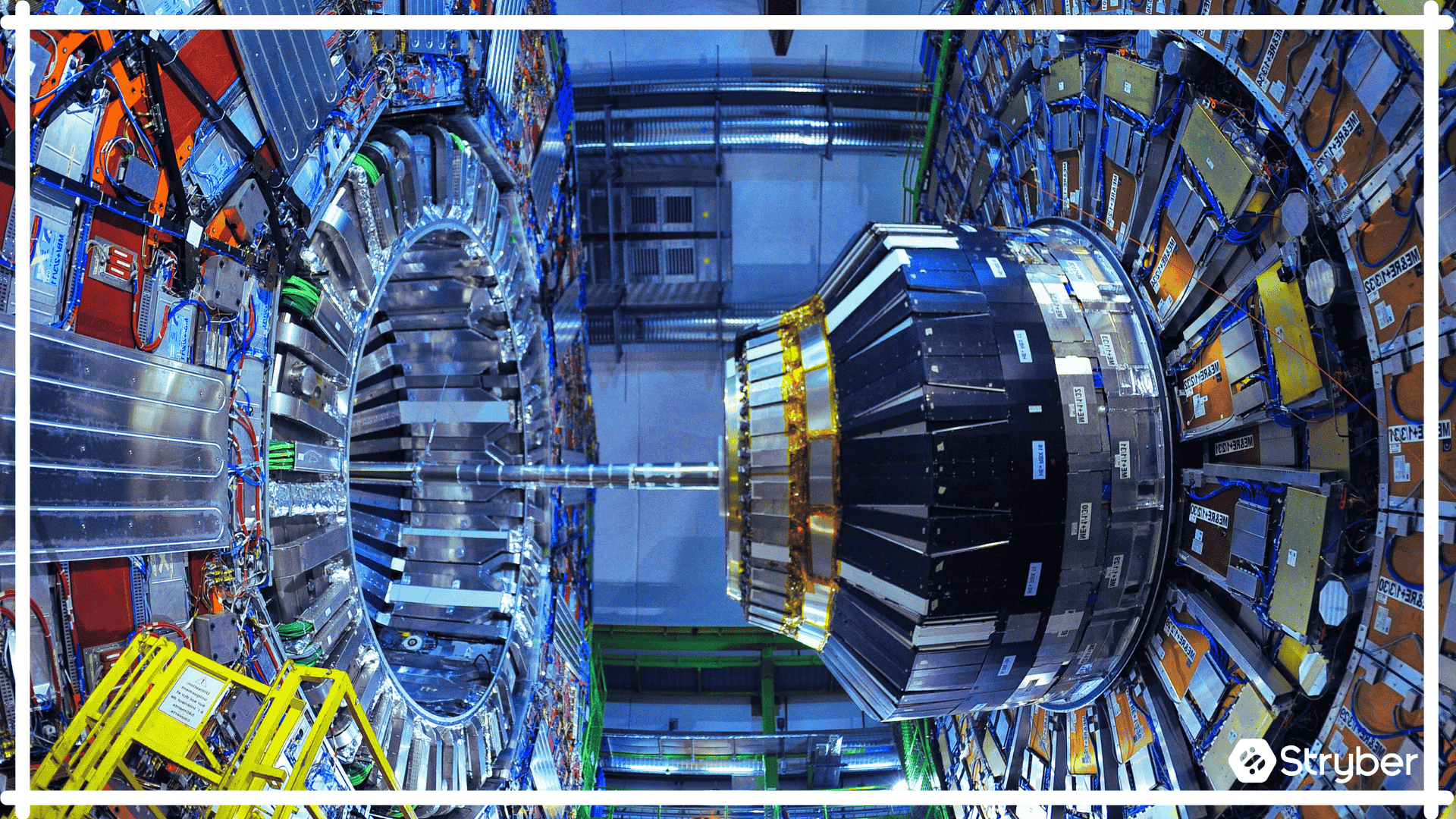

The ≈70 research institutes that form this large applied research organization push the envelope on innovation in a dizzying array of fields. From electronics to advanced materials, their combined research efforts touch the lives of millions in many different ways.

The research organization—let’s call it “the Organization”—handles all patents and commercialization on behalf of the institutes and is traditionally very strong in “technology push.” It wanted to strengthen its “market pull” approach as a basis for creating business model spin-offs based on the institutes’ tech.

Our 5-step process for success:

Identified potential fields and markets with know-how edge

Developed a prioritization and business-model design playbook with industry & investor feedback loops

Matched R&D assets to opportunity spaces; evaluation the right to play in each one

Installed systematic methodology for developing scalable business models addressing market needs

Successfully piloted the innovation framework launching three new ventures

A proven methodology for commercializing breakthrough R&D at scale

The organization now has the complete range of innovation vehicles and a proven methodology for commercializing breakthrough R&D at scale. The market pull framework will support the launch of new sustainable technology ventures, driving society-changing innovations with global resonance.

Scalable and robust methodology

Simple prioritization framework

New venture building expertise

Looking to turn your research investment into thriving ventures?

THE FULL PROJECT BREAKDOWN

The challenge: overcoming three major barriers to tech transfer

Despite the vast amount of research being conducted by the various institutes, the Organization found itself at a disadvantage in exploring the full range of market opportunities for these technologies—especially for R&D that lacked clear use cases, concrete applications, or paths to commercialization. Like many research organizations, the Organization was facing three challenges:

Discovery gap

With a broad research scope, it needed a clear methodology for discovering R&D with the highest market demand and commercial potential. It was also struggling to narrow down the fields where it might have the edge in technological know-how.

Funding gap

The Organization needed a structured system for financially backing spin-offs. It also had no platform for direct industry and investor engagement, which is crucial for transitioning technologies from low Technology Readiness Levels to a state of investability.

Skills gap

The institutes' core competencies centered around research. It did not have enough in-house entrepreneurial talent to form and drive forward spinoff projects of significant size and impact consistently.

Our game-changing approach

Unlocking and accelerating technology transfer at scale

We began by analyzing the Organization’s existing tools, projects, and innovative vehicle landscape. Everything that followed was tailored to the Organization’s needs, resources and decision-making culture.

To tackle the discovery and funding gaps, we designed a bespoke prioritization and business model design playbook. Patents, projects and know-how were screened against clear market criteria and investment theses to select business models with the highest commercial potential. “Graduates” of the screening process were then gated through several layers of scrutiny, including techno-economic analysis, impact assessment, technical due diligence, and go-to-market validation.

Technology transfer is not without risk. To mitigate this, we integrated market feedback loops into the process from day one via a collaboration platform for industry and investors. This ensured that market inputs—attitude, appetite, willingness to fund/pay—were continually on the radar.

The project timeline

Here is how we joined forces to evolve the client's capabilities to create new ventures leveraging cutting edge technology.

Developing the ideation process

Evolving Stryber's proven ideation process to align with the client's environment, we set out to define the evaluation criteria for ventures and begun mapping technologies and fields of expertise.

Implementing our shared vision

Based on the co-developed investment thesis, we sought to understand the market environment and corresponding competences. Analyzing existing value chains, we curated lists of relevant business ideas and evaluated business models based on defined filters.

Matched R&D assets to market opportunities

Compiling our research findings and relevant market data, we agreed a validated path forward.

Conducted technical due diligence

With assets specified, we begun carrying out interviews with researchers, and coordinating with institutes to define the IP strategy. Our teams organised interviews with experts and potential customers for further insight.

Designed new business models

We undertook further interviews with potential customers and experts alongside competitor analysis and market sizing. From here, we produced iterative solution designs and comprehensive impact assessments.

Refined business model and plan prototyping

The last step involved thorough market analysis and producing rough product designs for agreed ventures. Finally we consolidated all our findings, defined the go-to-market strategy, and supported with the go/no-go decision.

A robust framework custom designed to boost technology transfer

We piloted the new market-driven innovation approach with venture projects in the sustainability space, one in chemicals and one in building materials, among others. Both projects leveraged the institutes’ unique technological assets and IP—and both easily secured pre-seed funding through the Organization’s accelerator program. The Organization now has a comprehensive and scalable framework to turn innovation into pioneering new business ventures.

Ready to transform your cutting-edge research into thriving business ventures?

Fill out the form and let's talk about getting your next venture excubation to market.

We combine commercial acumen, strategic insight, and a venture capital mindset to unlock the full potential of your innovations. Our team of seasoned entrepreneurs and growth strategists transform Deep Tech ideas into sustainable business drivers by aligning R&D with real market opportunities.

With a proven track record delivering successful R&D projects and launching successful ventures for leading organizations, we’re your trusted partner at the critical intersection of strategy and execution.