Adjacent growth: the goldilocks zone of business expansion

Achieving breakthrough business growth demands finding the Goldilocks zone. A blend of strategies that ensures consistent growth for the core while diversifying revenue streams by exploiting new markets.

Easier said than done of course with a variety of approaches available for business leaders to explore and turbulent market conditions.

Some approaches are too “hot,” venturing far from a company’s core strengths resulting in costly missteps. Others are too “cold,” focusing solely on the core market and risking stagnation.

Adjacent growth, however, is "just right." It involves leveraging your existing strengths—such as brand equity, expertise, or distribution networks—to venture into new markets or product categories.

For mature businesses seeking meaningful, sustainable growth, it represents a balanced, practical strategy that capitalizes on their unique assets while minimizing risk.

In this article we take a look at what we mean by adjacent growth strategies, how to take advantage of your existing assets or IP, and how to implement a strategy that balances risk and reward for exceptional and sustained growth.

Why your business growth strategy is stuck

In the early years, growth comes relatively easily for many companies. Startups and scaleups with market-disrupting ideas and energetic momentum see impressive gains and significant investment.

They seize on new opportunities, reframe market norms, and take share from established competitors. But it only lasts so long.

Once an organization achieves scale and maturity, growth typically slows and potentially stalls altogether.

As markets become increasingly saturated, finding new avenues for growth feels like threading the eye of a needle while blindfolded.

Business frameworks like the Ansoff Matrix, Porter’s Five Forces, or the Three Horizon model, are supposed to offer solutions to this existential challenge.

The problem? They ignore the most important factor contributing to lackluster growth: the gravity and inertia of the existing organization.

The promise of innovation

Alongside market saturation, growing businesses develop more complex governance. This slows decision-making and puts the brakes on innovation. Change becomes complicated and challenging to agree on.

To combat this, businesses bet on internal innovation teams to turn things around. The idea being these groups can think differently, free from the crushing weight of the wider organization. Great in theory. Disappointing in reality.

Large companies are reluctant to cannibalize their own demand - particularly if one product line is a legacy cash cow with all the necessary infrastructure and people in place to support its continued status.

As a result, the business becomes more risk-averse. Instead of making bold new moves on instinct, it focuses on protecting existing revenues even more.

Time waits for no business

The uncomfortable truth is most business models have an expiry date. No amount of tinkering at the edges or plastering technology over the top will overcome this.

It’s also why transformation programs often fail: large businesses are almost entirely immune to being changed from the inside.

No amount of cloud migration, AI investment, or agile adoption will move the needle. Legacy operations, culture, and governance create a powerful gravitational pull, keeping new ideas firmly grounded.

That’s why established businesses should focus on adjacent growth opportunities with room to thrive beyond the forces holding them back.

Balancing growth and gravity

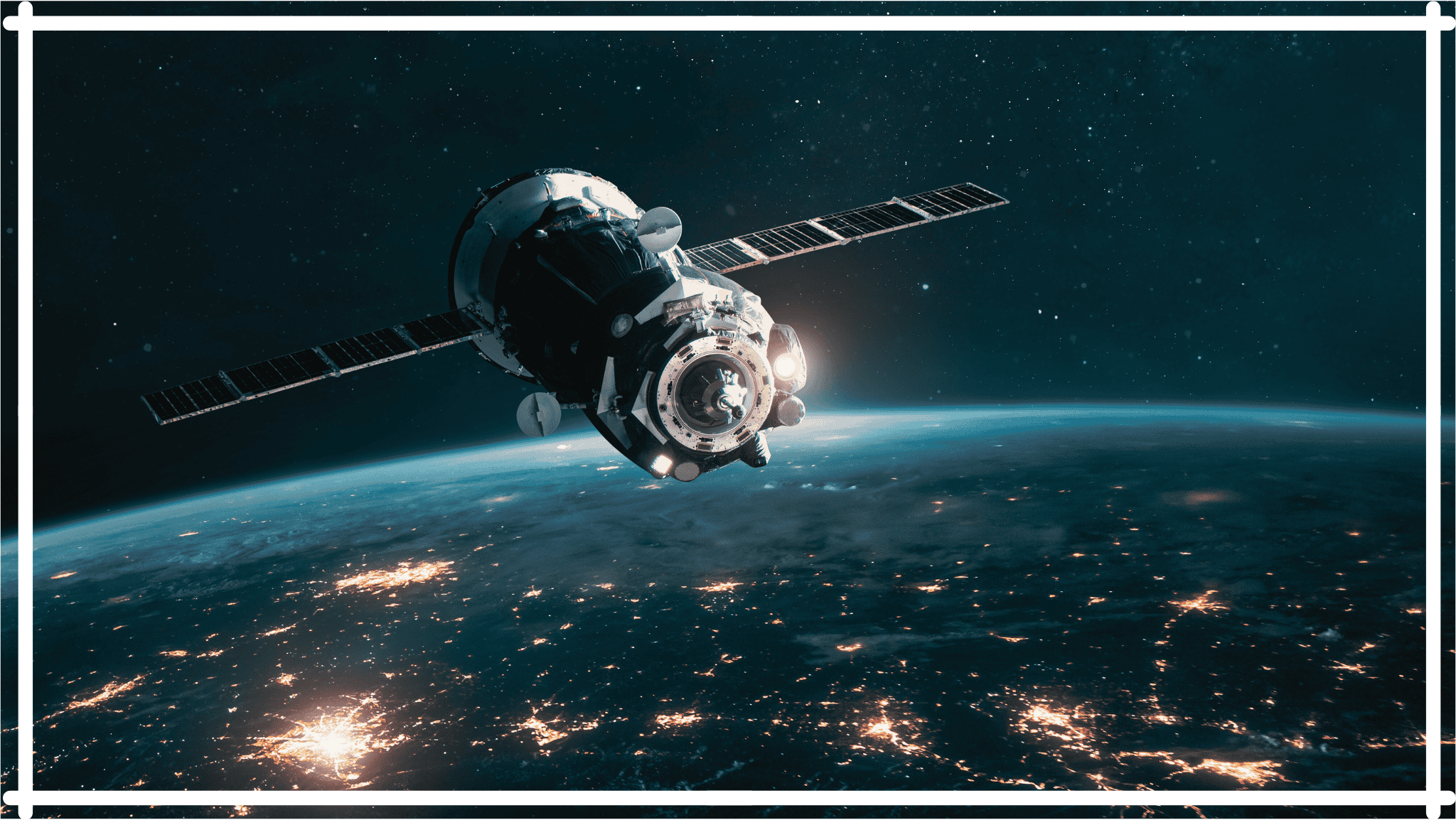

Adjacent opportunities exist in orbit around the core where they can still leverage existing assets and equity but are far enough removed to operate independently without the influence and gravity of the core operation.

If gravity is too strong, growth initiatives struggle to gain traction and get the support they need, constantly pulled back to ‘business as usual’. If there’s too little gravity, efforts can drift aimlessly, detached from the reality of growing a large business and ultimately destroying value.

The challenge is to escape the gravity keeping you stuck while maintaining enough to hold the organization together.

Wait, what do you mean by adjacent growth?

Adjacent growth is a strategic approach that extends a business into new areas closely related to its existing operations. These expansions can take various forms:

- Horizontal adjacencies

This involves leveraging a company’s core competencies—such as technology, processes, or brand reputation—to enter entirely new industries. For example, Tesla extended its expertise in battery technology and design into solar energy solutions. - Vertical adjacencies

Companies expand up or down the supply chain to capture more value. For instance, a manufacturer may start distributing its products directly to consumers through e-commerce platforms.

Successful adjacency strategies share the following characteristics:

- Strong alignment with existing assets: Businesses must identify opportunities where their current strengths provide a competitive advantage.

- Measurable synergies: The new venture should complement and enhance the core business, delivering tangible benefits such as cost savings, revenue growth, or market influence.

The maturity of the organization, growth trajectory, and shareholder ambitions will dictate which direction to pursue.

Every organization has finite resources to devote to growing the business (time, money, management focus etc). So while you are likely to pursue more than one approach, getting the right mix is critical to long-term success.

Read more: Learn how and when to focus on market penetration strategies

The parenting advantage

The concept of the “parenting advantage” highlights how a company’s core capabilities serve as a foundation for success in adjacent markets. This includes leveraging assets like brand equity, technological expertise, or distribution networks to gain an edge.

The main organizaton provides commercial cover while the new venture finds its feet. But they won’t suffer the crippling weight of legacy governance structures and entrenched conflicts of interest.

Those that get this right realize impressive performance gains. In fact, our research found that businesses with diversified revenue streams deliver significantly higher total shareholder return (TSR) versus those that stick to their core business only.

However, our data also shows that over a 10-year period, fewer than 30% of businesses succeed - often despite trying multiple approaches.

Case studies of success

- Apple

Apple’s expertise in design and technology created a natural pathway for its expansion into wearables. By applying its design principles and ecosystem integration, Apple Watch became a market leader, seamlessly fitting into the broader Apple ecosystem.- Amazon

Amazon’s core strengths in logistics and digital infrastructure enabled it to diversify successfully into cloud computing with Amazon Web Services (AWS). By leveraging its operational capabilities, Amazon not only reduced its internal costs but also created a multi-billion-dollar business unit.

Implementing adjacent strategies

Adjacent growth strategies can be executed through multiple approaches, each with its own benefits and challenges. Each demands robust, effective infrastructure. Let’s face it, no one gets rockets off the launchpad without support crews and planners at mission control.

- Bolt-On M&A

Acquisitions are a common way to achieve adjacency. Businesses identify targets that align with their core capabilities and integrate them to create synergies.

- Example: Disney’s acquisition of Pixar leveraged Disney’s storytelling expertise to enhance its animation division, leading to blockbusters like Toy Story 3 and Frozen.

- Best practices: Successful integrations require cultural alignment, clear synergy goals, and a robust integration plan.

- Innovative adjacencies

Some companies develop new offerings internally, guided by their existing knowledge and capabilities.

- Example: Google’s expansion into hardware with the Pixel smartphone capitalized on its software expertise, offering a tightly integrated device ecosystem.

- Example: Google’s expansion into hardware with the Pixel smartphone capitalized on its software expertise, offering a tightly integrated device ecosystem.

- Combination approaches

Businesses can balance internal innovation with external acquisitions. This approach allows companies to diversify risk while scaling new ventures.

- Example: Microsoft’s combination of internal R&D and strategic acquisitions (e.g., LinkedIn and GitHub) has bolstered its position in software and enterprise solutions.

Building a new venture from startup to scale-up to grown-up is challenging. When we analyzed the success rates and follow-on funding requirements of leading accelerator-backed portfolio companies, we discovered that 89% failed to grow to any significant size.

And by significant, we mean scaling a new line of business to around 10% of the legacy organization in five to seven years. If an initiative can’t deliver this level it won’t survive let alone achieve escape velocity.

The reality is single digits get rounded down to zero. And let’s be clear, for a large established corporation, 10% is a massive undertaking.

With such a low success rate, a portfolio approach is recommended. Launching many ideas with the knowledge some will fail.

Strong analytical capabilities and rapid speed of execution are therefore essential. You must be able to identify, assess, and create new ventures in as short a time as possible and be ruthless in killing those that don’t demonstrate traction and growth potential.

The potential of buy and build to accelerate innovation

In the buy-and-build scenario, the acquired business will have significant capabilities in the adjacent market. For its part, the core business will exploit shared capabilities to reduce costs and expand distribution opportunities.

The result is the best of both worlds: accelerating innovation without starting from scratch.

The core organization can rapidly diversify, building on the foundations of acquired companies with complementary products and services.

The caveat: An acquired business must remain separate from the core, free from the governance constraints hindering growth.

The risks and rewards of adjacent strategies

While adjacent growth offers significant potential, it is not without risk. Successful companies spread their bets, particularly in the early stages of diversification. They are strategic about what deserves continued investment and what needs to be shut down.

These decisions rely on high-quality data and the capacity to set aside emotion and bias, which can easily cloud judgment.

- Common pitfalls

- Overestimating synergies: Many businesses fail to accurately predict the value their core assets will bring to new ventures.

- Cultural mismatches: Acquisitions often falter when the acquired company’s culture clashes with the parent organization.

- Overextension: Pursuing too many adjacencies simultaneously can dilute focus and resources.

- Metrics to evaluate success of adjacent growth

- Revenue contribution from adjacencies.

- Margin improvement attributable to new ventures.

- Market share growth in the expanded segments.

Is an adjacent strategy right for your business?

For mature businesses, adjacent strategies represent one of the most practical and sustainable paths to growth. By leveraging existing strengths, companies can mitigate risk while opening new revenue streams and balancing their exposure across sectors, reducing vulnerability to market volatility.

Whether through strategic acquisitions or building new ventures, adjacent growth provides an opportunity to develop new products, services, and business models while staying anchored to core competencies.

The key is active involvement: shaping acquisitions and ventures to fully leverage the parent company’s advantages while being prepared to shut down underperforming initiatives quickly.

The flexibility of adjacent strategies makes them particularly effective for mature businesses operating in competitive, saturated markets. Start small, experiment strategically, and refine your approach.

With the right focus and execution, adjacent growth can help your business thrive in the "Goldilocks zone"—balanced, scalable, and perfectly suited to your strengths.

Are you ready to take the leap?

You may also like

These related articles

The 8 great myths of corporate innovation

Finding growth from your core: when to pursue market penetration strategies